haven't paid taxes in years uk

Havent paid taxes in years uk Friday October 21 2022 Edit. Agree a payment plan to pay the tax owed in instalments.

Crypto Tax Uk Ultimate Guide 2022 Koinly

High School or GED.

. The failure to file penalty also known as the delinquency penalty runs at a severe rate of 5 up to a maximum rate of 25 per month or partial month of lateness. Not paid tax for 10 years. However you would also pay national Insurance.

Connect one-on-one with 0 who will answer your question. First and foremost dont panic. Up to 15 cash back UK Tax.

HMRC Offshore Co-ordination Unit. Pay your outstanding debt. You will then have 14 days to either.

Please accept my apologies for the delay in writing to you. Up to 15 cash back Higher Officer HMRC. Thats a tax bill of 280.

You have stated your maximum annual earnings have been 7800 and minimum annual earnings were 3600 over the last 7 years. Late filing penalty 5 of unpaid balance for each month or part of a month that the return is late up to a maximum 25. Thank you - Answered by a verified UK Tax Professional.

After May 17th you will. What Happens If You DonT File Taxes For 5 Years Uk. Once you have received advice the non-disclosure.

I havent been earning any money elsewhere and have been pay taxes via my full time PAYE job for the past 5 years. For the self employed in 1415 that was 275 per week class 2 and 9 class 4 on profits over 7956 so again assuming you. You are only required to file a tax return if you meet specific requirements in a.

This means that if they become aware of an underpayment. Freelancing in the UK for a few years havent filed tax return but now live abroad. Late payment penalty 05 the unpaid.

If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation. 1 day agoThe NAO said that overall the 18 businesses that paid the DST which was first announced in the 2018 budget had a higher bill than the 351m they collectively paid in UK. Havent Filed Taxes in 10.

If you have not paid the debt after the 14 days we. Ask a UK tax advisor for answers ASAP. Before May 17th 2022 you will receive tax refunds for the.

Ad Need help with Back Taxes. TAX To cut a long story short I started freelancing while I was a student and was too scared misinformed to. HMRC HM Revenue Customs formerly the Inland Revenue.

If youve not done a tax return for a long time whether thats three years five years ten or even twenty years all is not lost. As part of the UKs 202021 tax year 6th April 2020 to 5th April 2021 dividend allowance is 2000 per year. Next year your salary is unchanged but you work the entire year thus over the course of the year youll be taxed on 12000-106001400 at 20.

We can help Call Toll-Free. 29 Dec 2020. If youre not eligible to use an offshore disclosure facility but still have tax to declare contact HMRC s Offshore Co-ordination Unit.

If you are convicted of an income tax. A surprising number of taxpayers simply find themselves years behind and this can be a great worry for you. My gross wages are 4500 a month and 575 a month car allowanceI.

Earnings from 8000 up to 20000 within five years flat thereafter.

Anthony Bourdain Owed 10 Years Of Taxes

16 Countries With No Income Taxes

For Question 2 Read The Following Or Any Article On Chegg Com

![]()

So I Havent Done A Tax Return In Maybe 6 Years Scale Of 1 To 10 How Screwed Am I R Ukpersonalfinance

If You Tax The Rich They Won T Leave Us Data Contradicts Millionaires Threats Inequality The Guardian

Irs Tax Refund Deadline What Are The Penalties If You Are Late Marca

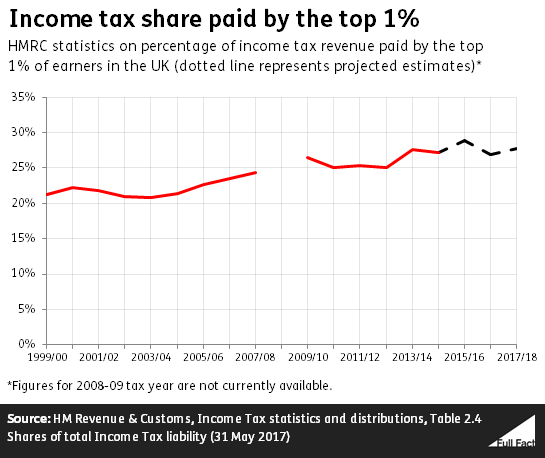

Do The Top 1 Of Earners Pay 28 Of The Tax Burden Full Fact

No It S Not Your Money Why Taxation Isn T Theft Tax Justice Network

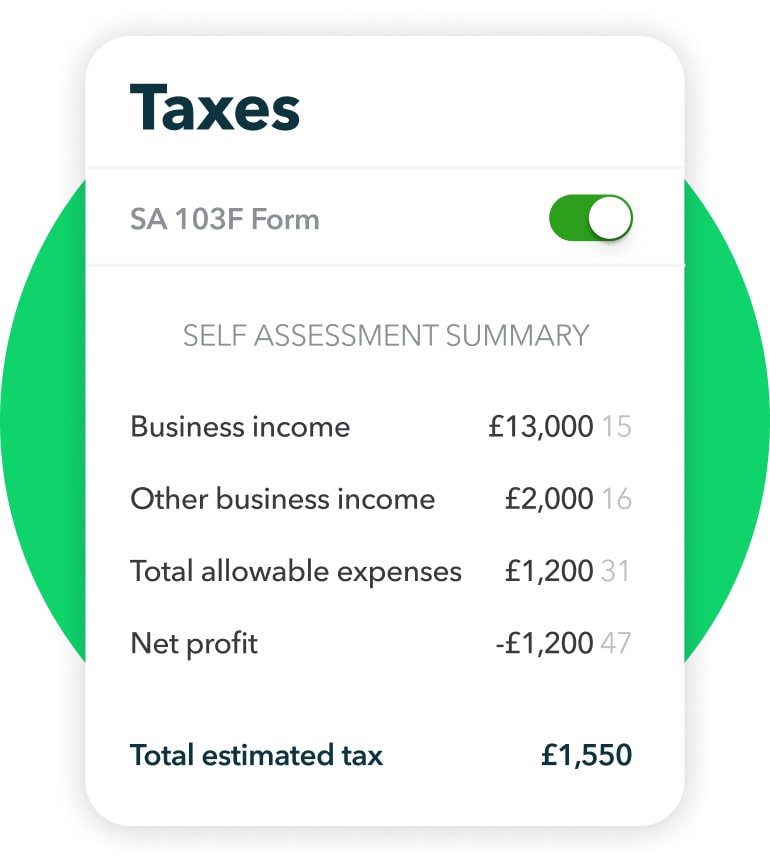

Hmrc Self Assessment Self Assessment Quickbooks Uk

Haven T Filed Your Tax Return The Penalties Are Coming Nerdwallet

Irs Tax Refund What To Do If You Didn T Receive Letter 6475 Marca

Simple Tax Guide For American Expats In The Uk

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What Happens If You Don T File Taxes For Your Business Bench Accounting

Tax Pros Report Increase In Erroneous Irs Notices Saying Taxes Haven T Been Paid

Paying Taxes In 2022 What You Need To Know The New York Times

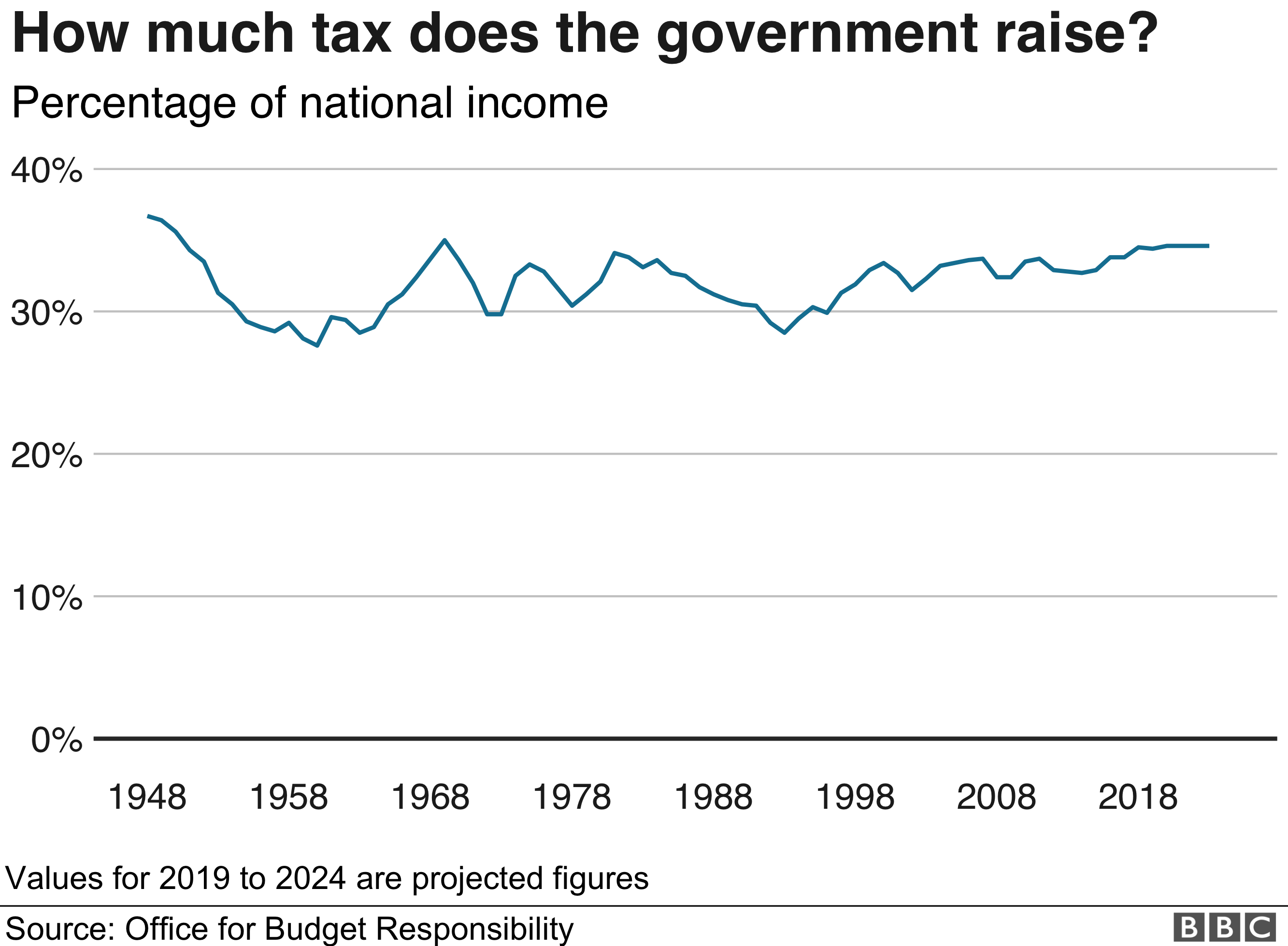

General Election 2019 How Much Tax Do British People Pay Bbc News